Class 12th Chapters

- 10. Financial Statement of a Company

- 11.Financial Statements Analysis & Tools

- 12. Accounting Ratios

- 13. Cash Flow Statement

Financial Statement of a Company

Topic – 1 | FINANCIAL STATEMENTS

Study Material & Notes

Study Material & Notes for the Chapter 8

FINANCIAL STATEMENTS

I. FINANCIAL STATEMENTS

- Every company registered under The Companies Act 2013 shall prepare its Balance Sheet, Statement of Profit and Loss and Notes to account thereto in accordance with the manner prescribed in the revised Schedule III to the Companies Act, 2013 to harmonise the disclosure requirement with the accounting standards and to converge with new reforms.

- The financial statements i.e., Balance sheet and Statement of Profit and Loss are required for external reporting and also for internal needs of the management like planning, decision-making and control.

- Balance Sheet: The Balance sheet shows all the assets owned by the concern, all the obligations or liabilities payable to outsiders or creditors and claims of the owners on a particular date. It is one of the important statements depicting the financial position or status or strength of an undertaking.

- Statement of Profit and Loss: The Statement of profit and loss is prepared for a specific period to determine the operational results of an undertaking. It is a statement of revenue earned and the expenses incurred for earning the revenue. It is a performance report showing the changes in income, expenses, profits and losses as a result of business operations during the year between two balance sheet dates.

Topic – 4 | CONTENTS OF THE BALANCE SHEET

Study Material & Notes

Study Material & Notes for the Chapter 10

FINANCIAL STATEMENTS

IV. Contents of the Balance Sheet

| Category | Main Head | Sub-Head | Item |

|---|---|---|---|

| Liability | Shareholders’ Funds | Share Capital | Equity Shares |

| Liability | Shareholders’ Funds | Share Capital | Preference Shares |

| Liability | Shareholders’ Funds | Share Capital | Calls-in-Arrears (Less) |

| Liability | Shareholders’ Funds | Reserves and Surplus | Forfeited Shares |

| Liability | Shareholders’ Funds | Reserves and Surplus | Capital Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Capital Redemption Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Securities Premium Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Debentures redemption Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Revaluation Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Shares Options Outstanding Amount |

| Liability | Shareholders’ Funds | Reserves and Surplus | Other Reserves |

| Liability | Shareholders’ Funds | Reserves and Surplus | Surplus i.e., Balance in Statement of Profit and Loss (Profit/Loss) |

| Liability | Non-Current Liabilities | Long-term Borrowings | Debentures |

| Liability | Non-Current Liabilities | Long-term Borrowings | Bonds |

| Liability | Non-Current Liabilities | Long-term Borrowings | Term Loan from Bank/Others |

| Liability | Non-Current Liabilities | Long-term Borrowings | Public Deposits |

| Liability | Non-Current Liabilities | Long-term Borrowings | Other Loans and Advances |

| Liability | Non-Current Liabilities | Deferred Tax Liabilities (Net) | Deferred Tax Liabilities |

| Liability | Non-Current Liabilities | Deferred Tax Liabilities (Net) | Deferred Tax Assets |

| Liability | Non-Current Liabilities | Other Long-term Liabilities | Premium Payable on Redemption of Preference Shares |

| Liability | Non-Current Liabilities | Long-term Provisions | Premium Payable on Redemption of Debentures |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Employees Retirement Benefits |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Gratuity |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Earned Leaves |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Warranty Claims |

| Liability | Current Liabilities | Short-term Borrowings | Loans repayable on demand |

| Liability | Current Liabilities | Short-term Borrowings | Bank Overdraft |

| Liability | Current Liabilities | Short-term Borrowings | Cash Credit from Banks |

| Liability | Current Liabilities | Short-term Borrowings | Current Maturities of Long-Term Debts |

| Liability | Current Liabilities | Short-term Borrowings | Loans repayable within 12 months |

| Liability | Current Liabilities | Short-term Borrowings | Deposits |

| Liability | Current Liabilities | Short-term Borrowings | Other Loans and Advances |

| Liability | Current Liabilities | Trade Payables | Sundry Creditors |

| Liability | Current Liabilities | Trade Payables | Bills Payable |

| Liability | Current Liabilities | Other Current Liabilities | Interest Accrued but not due on Borrowings |

| Liability | Current Liabilities | Other Current Liabilities | Interest Accrued and due on Borrowings |

| Liability | Current Liabilities | Other Current Liabilities | Income received in advance |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid Dividends |

| Liability | Current Liabilities | Other Current Liabilities | Excess application money refundable and interest thereon |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid matured deposits and interest accrued thereon |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid matured debentures and interest accrued thereon |

| Liability | Current Liabilities | Other Current Liabilities | Calls-in-Advance |

| Liability | Current Liabilities | Other Current Liabilities | Outstanding Expenses |

| Liability | Current Liabilities | Other Current Liabilities | Provident Funds Payable |

| Liability | Current Liabilities | Other Current Liabilities | ESI Payable |

| Liability | Current Liabilities | Other Current Liabilities | Other Payables within Operating Cycle/12 months |

| Liability | Current Liabilities | Short-term Provisions | Provision for Employee Benefits (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Provision for Expenses (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Provision for Tax (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Other Provisions (within Operating Cycle/12 months) |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Property Plant & Equipments |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Intangible Assets |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Capital Work in Progress |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Intangible Assets under Development |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Land |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Building |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Machinery |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Furniture & Fixtures |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Computers |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Vehicles |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Office Equipment |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Goodwill |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Brands |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Trademarks |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Computer Software |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Mining Rights |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Copy Rights |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Patents |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Licenses |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Franchise |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Capital Work in Progress | Tangible Assets under Construction |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets under Development | Patents under Development |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets under Development | Intellectual Property rights under Development |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Property (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Equity Instruments (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Preference Shares (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Government or Trust Securities (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Debentures (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Bonds (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Mutual Funds (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Partnership Firms (to be sold after 12 months) |

| Assets | Non-Current Assets | Deferred Tax Assets (Net) | Deferred Tax Assets (Net) |

| Assets | Non-Current Assets | Long-term Loan and Advances | Capital Advances (for tangible/intangible assets) |

| Assets | Non-Current Assets | Long-term Loan and Advances | Long-term Loans to Employees |

| Assets | Non-Current Assets | Long-term Loan and Advances | Long-term Advances to Vendors |

| Assets | Non-Current Assets | Other Non-current Assets | Security Deposits given (> 12 months/Operating Cycle) |

| Assets | Non-Current Assets | Other Non-current Assets | Long-term Trade Receivables (> 12 months/Operating Cycle) |

| Assets | Non-Current Assets | Other Non-current Assets | Unamortized Expenses/Losses |

| Assets | Non-Current Assets | Other Non-current Assets | Insurance Claims Recoverable |

| Assets | Current Assets | Current Investments | Investments in Equity Instruments (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Preference Shares (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Government or Trust Securities (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Debentures (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Bonds (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Mutual Funds (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Partnership Firms (to be sold within 12 months) |

| Assets | Current Assets | Inventories | Raw Materials |

| Assets | Current Assets | Inventories | Work-in-Progress |

| Assets | Current Assets | Inventories | Finished Goods |

| Assets | Current Assets | Inventories | Stock-in-Trade |

| Assets | Current Assets | Inventories | Goods Purchased for Trading |

| Assets | Current Assets | Inventories | Stores & Spares |

| Assets | Current Assets | Inventories | Loose Tools |

| Assets | Current Assets | Trade Receivables | Debtors |

| Assets | Current Assets | Trade Receivables | Provision for Doubtful Debts |

| Assets | Current Assets | Trade Receivables | Bills Receivables |

| Assets | Current Assets | Cash and Cash Equivalents | Cash in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Credit Balance as per Bank Accounts |

| Assets | Current Assets | Cash and Cash Equivalents | Cheques in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Drafts in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Fixed Deposits with Banks |

| Assets | Current Assets | Short-term Loans and Advances | Loans and Advances realized within 12 months/Operating Cycle |

| Assets | Current Assets | Other Current Assets | Prepaid Expenses |

| Assets | Current Assets | Other Current Assets | Accrued Income |

| Assets | Current Assets | Other Current Assets | Dividend Receivable |

| Assets | Current Assets | Other Current Assets | Advance Taxes |

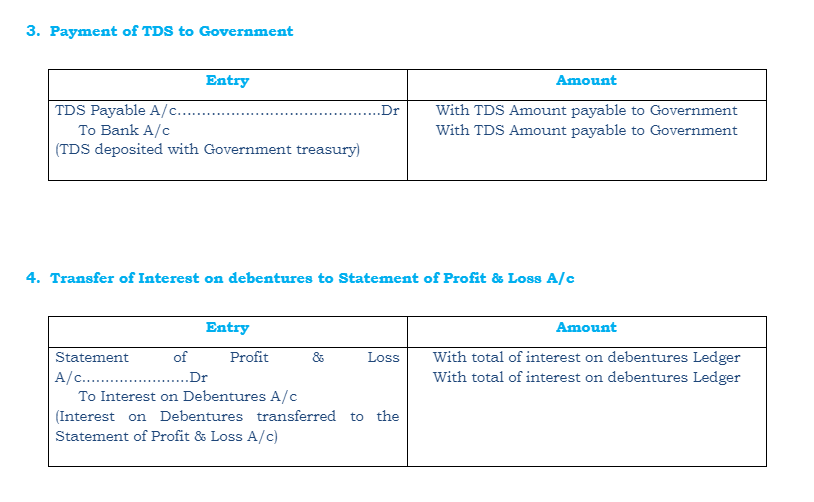

Topic – 5 | Interest on Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

V. INTEREST ON DEBENTURES

- When a company issues debentures, it has to pay interest thereon at fixed percentage periodically (quarterly/half yearly/yearly) until debentures are repaid

- Interest is computed at the nominal value of debentures.

- This percentage is usually as part of the name of debentures like 8% debentures, 10% debentures, etc.

- Interest on debenture is a charge against the profit of the company and must be paid regularly even when Company suffers a loss or does not earn profits.

- According to Income Tax Act, 1961, a company paying interest on debentures is required to deduct income tax at the prescribed rate from the gross amount of debenture interest (if it exceeds the prescribed limit) before any payment is made to the debenture holders (Tax Deducted at Source).

Illustration

Debenture Face Value | Rs. 100 |

Number of Debentures | 10,000 |

Period | 6 months |

Interest rate | 9% per annum |

Profit & Loss A/c | Loss Rs. 75,00,000 |

Interest Amount | (10,000×100)x9%x6/12 = Rs. 45,000 |

Income Tax (TDS) @ 10% | 45,000×10% = Rs. 4,500/- |

Interest Net of TDS | 45,000-4,500=Rs. 40,500 |

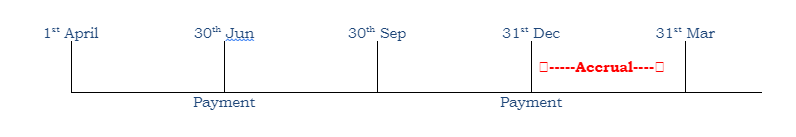

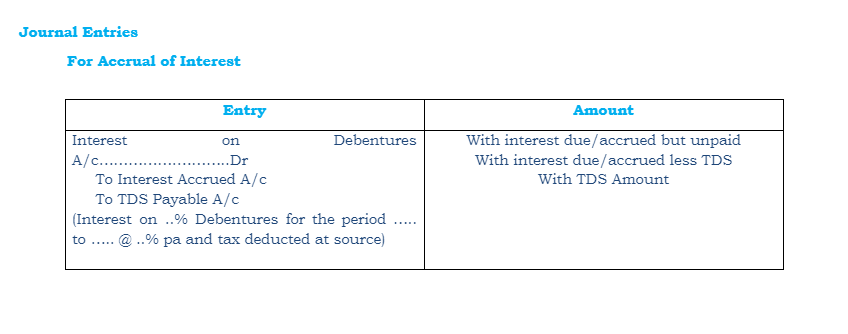

Interest on Debentures – Accrual

- Interest may be paid periodically and the period may be quarterly, half-yearly or yearly

- The date of payment of interest may be coincide with the end of the accounting period

- For example interest is payable half yearly on 30th Jun and 31st December

- In this case, at the end of the accounting year on 31st March, interest for the period 1st Jan to 31st Mar needs to be accrued in the books of accounts

Topic – 6 | Writing Off Discount/Loss on Issue of Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

VI. WRITING OFF DISCOUNT/LOSS ON ISSUE OF DEBENTURES

- Discount or Loss on issue of debentures is a capital loss and is written-off in the year it is incurred i.e. in the year debentures are allotted.

- Discount or loss is written-off from the following:

- From Capital Reserve

- From Securities Premium Reserve [section 52(2)]

- From General Reserve

- Against revenue profits of the year

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Financial Statements Analysis & Tools

Topic – 1 | FINANCIAL STATEMENTS ANALYSIS

Study Material & Notes

Study Material & Notes for the Chapter 11

Financial Statements Analysis & Tools

I. FINANCIAL STATEMENT ANALYSIS

i. Meaning of Financial Statement Analysis

- Financial statement analysis is a judgemental process which aims to estimate current and past financial positions and the results of the operation of an enterprise, with primary objective of determining the best possible estimates and predictions about the future conditions.

- It essentially involves regrouping and analysis of information provided by financial statements to establish relationships and throw light on the points of strengths and weaknesses of a business enterprise, which can be useful in decision-making involving comparison with other firms (cross sectional analysis) and with firms’ own performance, over a time period (time series analysis).

- The term ‘financial analyses includes both ‘analysis and interpretation’. The term analysis means simplification of financial data by methodical classification given in the financial statements. Interpretation means explaining the meaning and significance of the data.

ii. Objectives of Financial Statements Analysis

- To assess the current profitability and operational efficiency of the firm as a whole as well as its different departments so as to judge the financial health of the firm.

- To ascertain the relative importance of the different components of the financial position of the firm

- To identify the reasons for change in the profitability/ financial position of the firm.

- To judge the ability of the firm to repay its debt and assessing the short-term as well as the long-term liquidity position of the firm.

iii. Significance/Importance/Uses of Financial Statements Analysis

- Investors: Shareholders or proprietors of the business are interested in the well-being of the business. They like to know the earning capacity of the business and its prospects of future growth.

- Management: The management is interested in the financial position and performance of the enterprise as a whole and of its various divisions. It helps them in preparing budgets and assessing the performance of various departmental heads.

- Trade Unions: They are interested in financial statements for negotiating the wages or salaries or bonus agreement with the management.

- Lenders: Lenders to the business like debenture holders, suppliers of loans and lease are interested to know short term as well as long term solvency position of the entity.

- Tax Authorities: Tax authorities are interested in financial statements for determining the tax liability.

- Suppliers/Creditors: The suppliers and other creditors are interested to know solvency of the business i.e. the ability of the company to meet the debts as and when they fall due.

- Researchers: They are interested in financial statements for undertaking research work in business affairs and practices.

- Employees: They are interested to know the growth of profit. As a result of which they can demand better remuneration and congenial working environment.

- Government: Government and its regulatory agencies need financial information to regulate the activities of the enterprises/ industries and determine taxation policy. They suggest measures to formulate policies and regulations.

- Stock Exchange: The stock exchange members take interest in financial statements for the purpose of analysis because they provide useful financial information about companies.

iv. Limitations of Financial Statements Analysis

- Limitations of Financial Statements: Financial analysis is based on financial statements, however, financial statements itself suffer from certain limitations, for example, (a) sometimes the information given in financial statements are incomplete and not authentic, (b) financial Statements are based on accounting concepts and conventions. As such, the utility of financial analysis is decreased due to the shortcomings of financial statements.

- Affected by Window Dressing: Some firms resort to window-dressing their financial statements to cover up bad financial position on the eve of accounting date. For example, they may not record the purchases made at the end of the year or they may overvalue their closing stock. In such cases, the results obtained by analysis of financial statements will be misleading.

- Subjectivity: If two firms adopt different accounting policies, the comparison between the two will be unreliable. For example, one firm may provide depreciation on original cost method, whereas the other firm may adopt the written-down value method for providing the depreciation. Similarly, the method of valuation of closing stock may also differ from one firm to another. The results obtained from the comparison of the financial statements of such firms may give misleading picture.

- Difficulty in Forecasting: Financial statements are a record of past events and historical facts. In the fast changing and developing modern business, the analysis of past information may not be of much use in future forecasting. Continuous changes take place in the demand of the product, policies adopted by the firm, the position of competition etc. As such, no estimate based on the analysis of historical facts can be made for future.

- Lack of Qualitative Analysis: Financial statements record only those events and transactions which can be expressed in terms of money. Qualitative aspects of business units are omitted from the books at all as these cannot be expressed in monetary terms. Thus, changes in management, reputation of the business, cordial management-labour relations, firm’s ability to develop new products, efficiency of management, satisfaction of firm’s customers etc. which have a vital bearing on the profitability of the company are all ignored and omitted from being recorded because all of these are qualitative in nature.

Topic – 2 | COMPARATIVE STATEMENTS

Study Material & Notes

Study Material & Notes for the Chapter 11

Financial Statements Analysis & Tools

II. COMPARATIVE STATEMENTS

i. Comparative Statements

- It is the statement prepared to compare individual items or components of the financial statements of two or more years of a company.

- The amount of each component of company’s financial statements is placed side by side and difference is ascertained, which is shown as a percentage of the base year.

- A comparison of components of company’s financial statements of two or more years is known as Intra-Firm comparison, whereas Comparison of company’s financial statements with another Organisation is called inter-firm comparison.

ii. Comparative Balance Sheet

- It is the statement prepared to compare individual items or components of Balance Sheet of two or more years of a company.

iii. Comparative Statement of Profit & Loss

- It is the statement prepared to compare individual items of Statement of Profit & Loss of two or more years of a company.

Topic – 3 | COMMON SIZE STATEMENTS

Study Material & Notes

Study Material & Notes for the Chapter 11

Financial Statements Analysis & Tools

III. COMMON SIZE STATEMENTS

i. Common Size Statements

- Common-size statement means a statement which expresses all items of a financial statement as a percentage of some common base.

- It ascertains the relative importance of different components of the financial statement.

ii. Common Size Balance Sheet

- Common-size balance sheet means a Balance sheet in which figures reported in Balance sheet are converted into percentages to total assets or total of equity and liabilities.

- In the Balance sheet, Total of assets or Total of equity & liabilities is taken as 100 and all other figures are expressed as a percentage of the total assets or total equity & liabilities.

iii. Common Size Statement of Profit & Loss

- Common-size statement of profit and loss means an Income statement in which figures reported in the Statement of profit & loss are converted into percentages to Revenue from Operations.

- In Statement of profit and loss, sales may be assumed to be equal to 100 and all other figures are expressed as a percentage of the Sales/Revenue from Operations.

Topic – 4 | CONTENTS OF THE BALANCE SHEET

Study Material & Notes

Study Material & Notes for the Chapter 10

FINANCIAL STATEMENTS

IV. Contents of the Balance Sheet

| Category | Main Head | Sub-Head | Item |

|---|---|---|---|

| Liability | Shareholders’ Funds | Share Capital | Equity Shares |

| Liability | Shareholders’ Funds | Share Capital | Preference Shares |

| Liability | Shareholders’ Funds | Share Capital | Calls-in-Arrears (Less) |

| Liability | Shareholders’ Funds | Reserves and Surplus | Forfeited Shares |

| Liability | Shareholders’ Funds | Reserves and Surplus | Capital Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Capital Redemption Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Securities Premium Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Debentures redemption Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Revaluation Reserve |

| Liability | Shareholders’ Funds | Reserves and Surplus | Shares Options Outstanding Amount |

| Liability | Shareholders’ Funds | Reserves and Surplus | Other Reserves |

| Liability | Shareholders’ Funds | Reserves and Surplus | Surplus i.e., Balance in Statement of Profit and Loss (Profit/Loss) |

| Liability | Non-Current Liabilities | Long-term Borrowings | Debentures |

| Liability | Non-Current Liabilities | Long-term Borrowings | Bonds |

| Liability | Non-Current Liabilities | Long-term Borrowings | Term Loan from Bank/Others |

| Liability | Non-Current Liabilities | Long-term Borrowings | Public Deposits |

| Liability | Non-Current Liabilities | Long-term Borrowings | Other Loans and Advances |

| Liability | Non-Current Liabilities | Deferred Tax Liabilities (Net) | Deferred Tax Liabilities |

| Liability | Non-Current Liabilities | Deferred Tax Liabilities (Net) | Deferred Tax Assets |

| Liability | Non-Current Liabilities | Other Long-term Liabilities | Premium Payable on Redemption of Preference Shares |

| Liability | Non-Current Liabilities | Long-term Provisions | Premium Payable on Redemption of Debentures |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Employees Retirement Benefits |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Gratuity |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Earned Leaves |

| Liability | Non-Current Liabilities | Long-term Provisions | Provision for Warranty Claims |

| Liability | Current Liabilities | Short-term Borrowings | Loans repayable on demand |

| Liability | Current Liabilities | Short-term Borrowings | Bank Overdraft |

| Liability | Current Liabilities | Short-term Borrowings | Cash Credit from Banks |

| Liability | Current Liabilities | Short-term Borrowings | Current Maturities of Long-Term Debts |

| Liability | Current Liabilities | Short-term Borrowings | Loans repayable within 12 months |

| Liability | Current Liabilities | Short-term Borrowings | Deposits |

| Liability | Current Liabilities | Short-term Borrowings | Other Loans and Advances |

| Liability | Current Liabilities | Trade Payables | Sundry Creditors |

| Liability | Current Liabilities | Trade Payables | Bills Payable |

| Liability | Current Liabilities | Other Current Liabilities | Interest Accrued but not due on Borrowings |

| Liability | Current Liabilities | Other Current Liabilities | Interest Accrued and due on Borrowings |

| Liability | Current Liabilities | Other Current Liabilities | Income received in advance |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid Dividends |

| Liability | Current Liabilities | Other Current Liabilities | Excess application money refundable and interest thereon |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid matured deposits and interest accrued thereon |

| Liability | Current Liabilities | Other Current Liabilities | Unpaid matured debentures and interest accrued thereon |

| Liability | Current Liabilities | Other Current Liabilities | Calls-in-Advance |

| Liability | Current Liabilities | Other Current Liabilities | Outstanding Expenses |

| Liability | Current Liabilities | Other Current Liabilities | Provident Funds Payable |

| Liability | Current Liabilities | Other Current Liabilities | ESI Payable |

| Liability | Current Liabilities | Other Current Liabilities | Other Payables within Operating Cycle/12 months |

| Liability | Current Liabilities | Short-term Provisions | Provision for Employee Benefits (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Provision for Expenses (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Provision for Tax (within Operating Cycle/12 months) |

| Liability | Current Liabilities | Short-term Provisions | Other Provisions (within Operating Cycle/12 months) |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Property Plant & Equipments |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Intangible Assets |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Capital Work in Progress |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets | Intangible Assets under Development |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Land |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Building |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Machinery |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Furniture & Fixtures |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Computers |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Vehicles |

| Assets | Non-Current Assets | Property, Plant and Equipment and Intangible Assets-Property Plant & Equipments | Office Equipment |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Goodwill |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Brands |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Trademarks |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Computer Software |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Mining Rights |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Copy Rights |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Patents |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Licenses |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets | Franchise |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Capital Work in Progress | Tangible Assets under Construction |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets under Development | Patents under Development |

| Assets | Non-Current Assets | Property, Plant & Equipment and Intangible Assets-Intangible Assets under Development | Intellectual Property rights under Development |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Property (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Equity Instruments (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Preference Shares (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Government or Trust Securities (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Debentures (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Bonds (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Mutual Funds (to be sold after 12 months) |

| Assets | Non-Current Assets | Non-Current Investments | Investments in Partnership Firms (to be sold after 12 months) |

| Assets | Non-Current Assets | Deferred Tax Assets (Net) | Deferred Tax Assets (Net) |

| Assets | Non-Current Assets | Long-term Loan and Advances | Capital Advances (for tangible/intangible assets) |

| Assets | Non-Current Assets | Long-term Loan and Advances | Long-term Loans to Employees |

| Assets | Non-Current Assets | Long-term Loan and Advances | Long-term Advances to Vendors |

| Assets | Non-Current Assets | Other Non-current Assets | Security Deposits given (> 12 months/Operating Cycle) |

| Assets | Non-Current Assets | Other Non-current Assets | Long-term Trade Receivables (> 12 months/Operating Cycle) |

| Assets | Non-Current Assets | Other Non-current Assets | Unamortized Expenses/Losses |

| Assets | Non-Current Assets | Other Non-current Assets | Insurance Claims Recoverable |

| Assets | Current Assets | Current Investments | Investments in Equity Instruments (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Preference Shares (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Government or Trust Securities (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Debentures (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Bonds (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Mutual Funds (to be sold within 12 months) |

| Assets | Current Assets | Current Investments | Investments in Partnership Firms (to be sold within 12 months) |

| Assets | Current Assets | Inventories | Raw Materials |

| Assets | Current Assets | Inventories | Work-in-Progress |

| Assets | Current Assets | Inventories | Finished Goods |

| Assets | Current Assets | Inventories | Stock-in-Trade |

| Assets | Current Assets | Inventories | Goods Purchased for Trading |

| Assets | Current Assets | Inventories | Stores & Spares |

| Assets | Current Assets | Inventories | Loose Tools |

| Assets | Current Assets | Trade Receivables | Debtors |

| Assets | Current Assets | Trade Receivables | Provision for Doubtful Debts |

| Assets | Current Assets | Trade Receivables | Bills Receivables |

| Assets | Current Assets | Cash and Cash Equivalents | Cash in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Credit Balance as per Bank Accounts |

| Assets | Current Assets | Cash and Cash Equivalents | Cheques in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Drafts in hand |

| Assets | Current Assets | Cash and Cash Equivalents | Fixed Deposits with Banks |

| Assets | Current Assets | Short-term Loans and Advances | Loans and Advances realized within 12 months/Operating Cycle |

| Assets | Current Assets | Other Current Assets | Prepaid Expenses |

| Assets | Current Assets | Other Current Assets | Accrued Income |

| Assets | Current Assets | Other Current Assets | Dividend Receivable |

| Assets | Current Assets | Other Current Assets | Advance Taxes |

Topic – 5 | Interest on Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

V. INTEREST ON DEBENTURES

- When a company issues debentures, it has to pay interest thereon at fixed percentage periodically (quarterly/half yearly/yearly) until debentures are repaid

- Interest is computed at the nominal value of debentures.

- This percentage is usually as part of the name of debentures like 8% debentures, 10% debentures, etc.

- Interest on debenture is a charge against the profit of the company and must be paid regularly even when Company suffers a loss or does not earn profits.

- According to Income Tax Act, 1961, a company paying interest on debentures is required to deduct income tax at the prescribed rate from the gross amount of debenture interest (if it exceeds the prescribed limit) before any payment is made to the debenture holders (Tax Deducted at Source).

Illustration

Debenture Face Value | Rs. 100 |

Number of Debentures | 10,000 |

Period | 6 months |

Interest rate | 9% per annum |

Profit & Loss A/c | Loss Rs. 75,00,000 |

Interest Amount | (10,000×100)x9%x6/12 = Rs. 45,000 |

Income Tax (TDS) @ 10% | 45,000×10% = Rs. 4,500/- |

Interest Net of TDS | 45,000-4,500=Rs. 40,500 |

Interest on Debentures – Accrual

- Interest may be paid periodically and the period may be quarterly, half-yearly or yearly

- The date of payment of interest may be coincide with the end of the accounting period

- For example interest is payable half yearly on 30th Jun and 31st December

- In this case, at the end of the accounting year on 31st March, interest for the period 1st Jan to 31st Mar needs to be accrued in the books of accounts

Topic – 6 | Writing Off Discount/Loss on Issue of Debentures:

Study Material & Notes

Study Material & Notes for the Chapter 9

COMPANY – ISSUE OF DEBENTURES

VI. WRITING OFF DISCOUNT/LOSS ON ISSUE OF DEBENTURES

- Discount or Loss on issue of debentures is a capital loss and is written-off in the year it is incurred i.e. in the year debentures are allotted.

- Discount or loss is written-off from the following:

- From Capital Reserve

- From Securities Premium Reserve [section 52(2)]

- From General Reserve

- Against revenue profits of the year

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Accounting Ratios

Topic – 1 | MEANING, OBJECTIVES & CLASSICFICATION

Study Material & Notes

Study Material & Notes for the Chapter 11

COMPANY – ACCOUNTING RATIOS

I. Meaning, Objectives & Classification of Accounting Ratios

A. Accounting Ratios – Meaning and Definition

- Ratio: A ratio is a relationship between two things expressed in numbers or amounts.

- Accounting Ratios: When ratios are calculated on the basis of accounting information, than these are called accounting ratios.

- Ratios Analysis: It is a technique of analysis of financial statements to conduct a quantitative analysis of information in a company’s financial statements.

- Expression of Accounting Ratio:

- Pure Ratio like 2:1. All liquidity and solvency ratios are expressed in pure form.

- Percentage like 15%. All profitability ratios are presented in percentage form.

- Times, rate or number like 4 times. All turnover ratios and Interest Coverage Ratio are presented in this form.

- Fraction like ¾

B. Accounting Ratios – Objectives/Uses/Advantages

- Simplify complex figures and establish relationships

- Ratios help in simplifying the complex accounting figures and bring out their relationships.

- They help summarise the financial information effectively and assess the managerial efficiency, firm’s credit worthiness, earning capacity, etc.

- Various Comparisons

- Ratios help comparisons with certain benchmarks to assess as to whether firm’s performance is better or otherwise.

- For this purpose, the profitability, liquidity, solvency, etc., of a business, may be compared:

- over a number of accounting periods with itself (Intra-firm Comparison/Time Series Analysis),

- with other business enterprises (Inter-firm Comparison/Cross-sectional Analysis)

with standards set for that firm/industry (comparison with standard (or industry expectations).

Helps to understand efficacy of decisions

The ratio analysis helps you to understand whether the business firm has taken the right kind of operating, investing and financing decisions. It indicates how far they have helped in improving the performance.

- Identification of problem areas

- Ratios help business in identifying the problem areas as well as the bright areas of the business. Problem areas would need more attention and bright areas will need polishing to get better results.

Topic – 2 | LIQUIDITY RATIOS

Study Material & Notes

Study Material & Notes for the Chapter 11

COMPANY – ACCOUNTING RATIOS

II. LIQUIDITY RATIOS

A. Meaning

- The term liquidity refers to the ability of the company to meet its current liabilities.

- Liquidity ratios are financial ratios that help in analyzing the ability of a business entity to meet its short-term obligations/liabilities.

- Liquidity ratios measure the firms’ ability to fulfil short term commitments out of its liquid assets

- These are analysed by looking at the amounts of current assets and current liabilities in the balance sheet.

- Higher ratio means better capacity to meet its current obligation.

B. Type

1. Current Ratio

2. Liquid Ratio

C. Current Ratio

a. Meaning

- The Current ratio measures the ability of a company to pay its current liabilities using its current assets.

- A higher Current ratio indicates that the company has sufficient current assets to meet its current liabilities.

b. Formula

- It is calculated by dividing Current Assets by Current Liabilities.

- Current Ratio = Current AssetsCurrent Liabilities

- Current Assets = Current Investments + Inventories (excluding stores & spares and Loose tools) + Trade Receivables (Net of provisions) + Cash & Cash equivalents + Short Term Loans & Advances + Other Current Assets

- Current Liabilities = Short Term Borrowings + Trade Payables + Other Current Liabilities + Short Term Provisions

- Working Capital = Current Assets – Current Liabilities

c. Important Considerations

- The ratio is expressed pure i.e. 2:1

- The ideal range for the Current ratio is 2:1

- A Current ratio of less than 1 indicates that the company may have difficulty meeting its current liabilities.

- Higher Current ratio means better capacity to meet its current obligations.

- Very high Current ratio shows funds idleness

D. Liquid Ratio

a. Meaning

- The Liquid ratio is a more stringent measure of liquidity. It measures the ability of a company to meet its current liabilities using its quick assets, which include cash, marketable securities, and accounts receivable.

- Its based on highly liquid assets that can be converted into cash quickly

- The Liquid ratio is also known as Quick ratio or Acid-test ratio.

b. Formula

- It is calculated by dividing Liquid Assets by Current Liabilities.

- Liquid Ratio = Liquid Assets/Current Liabilities

- Liquid Assets = Current Investments + Trade Receivables (Net of provisions) + Cash & Cash equivalents + Short Term Loans & Advances + Other Current Assets excluding Prepaid Expenses

- Current Liabilities = Short Term Borrowings + Trade Payables + Other Current Liabilities + Short Term Provisions

- Liquid Assets = Current Assets – Inventories – Prepaid Expenses

c. Important Considerations

- The ratio is expressed pure i.e. 2:1

- The ideal range for the Liquid ratio is 1.5 : 1

- A Liquid ratio less than 1 indicates that the company may have difficulty meeting its current liabilities even if all of its current assets are liquidated.

- Higher Liquid ratio means better capacity to meet its current obligations.

- Very high Liquid ratio shows funds idleness

Topic – 3 | SOLVENCY RATIOS

Study Material & Notes

Study Material & Notes for the Chapter 11

COMPANY – ACCOUNTING RATIOS

III. SOLVENCY RATIOS

A. Meaning

- The term ‘solvency’ refers to the ability of a concern to meet its long term obligations.

- The long-term liability of a firm is towards debenture holders, financial institutions providing medium and long term loans and public who made deposits

- The Solvency ratios indicate firm’s ability to meet Its interest payments and repayment schedules associated with its long term borrowings.

B. Type

1. Debt Equity Ratio

2. Total Assets to Debt Ratio

3. Proprietary Ratio

4. Interest Coverage Ratio

C. Debt Equity Ratio

a. Meaning

- It is calculated to know the relative claims of outsiders and the owners against the firm’s assets.

- This ratio establishes the relationship between the outsiders funds and the shareholders funds

b. Formula

- It is computed by dividing Long-term debts by Shareholders Funds

- Debt Equity Ratio = Long-term DebtsShareholders Funds

- Long Term Debts = Long Term Borrowings (i.e. debentures, mortgages, public deposits) + Long term provisions

- Shareholders Funds = Equity Share Capital + Preference Share Capital + Reserves & Surplus – Fictitious Assets

or

- Shareholders Funds = Non Current Assets (i.e. Tangible & Intangible assets, Non-current Investments + Long-term Loans & Advances) + Working Capital (i.e. Current Assets – Current Liabilities) Non-current Liabilities (i.e. Long-term Borrowings + Long-term Provisions)

c. Important Considerations

- The Debt Equity ratio is expressed pure i.e. 1:1

- The ideal range for the Debt Equity ratio is 2

- A lower Debt Equity ratio is preferred as it indicates less debt on a company’s balance sheet.

- The purpose of debt equity ratio is to derive an idea of the amount of capital supplied to the Organization by the Owners.

- This ratio is very useful to assess the soundness of long term financial position of the firm.

- It also indicates the extent to which the firm depends upon outsiders for its existence.

- A low debt equity ratio implies the use of more equity than debt.

D. Total Assets to Debt Ratio

a. Meaning

- Total Assets to Debt ratio measures the extent of the coverage of long-term debts by assets.

- This ratio measures safety margin available to lenders of long term debt

b. Formula

- It is computed by dividing Total Assets by Debt

- Total Assets to Debt Ratio = Total Assets/(Debt i.e Long-term Loans)

- Total Assets = Non-current assets + Current Assets

- Long Term Debts = Long Term Borrowings (i.e. debentures, mortgages, public deposits) + Long term provisions + Long-term liabilities

- Non-current assets (i.e. Tangible & intangible assets, non current investments + long term loans & advances)

- Current Assets (i.e. Current Investments + Inventories (excluding stores & spares and Loose tools) + Trade Receivables (Net) + Cash & Cash equivalents + Short Term Loans & Advances + Other Current Assets)

c. Important Considerations

- The Total Assets to Debt ratio is expressed pure i.e. 2:1

- This ratio measures the safety margin available to lenders of long-term debts. It measures the extent to which debt is being covered by assets

- A higher total assets to debt ratio is generally seen as a healthy sign of financial health, indicating that a company has sufficient assets to cover its debts.

- A lower ratio suggests a higher level of financial risk, as it indicates that a significant portion of assets is financed by debt.

- A declining ratio may indicate that a company is taking on more debt relative to its assets, which can be a warning sign.

E. Proprietary Ratio

a. Meaning

- Proprietary ratio establishes the relationship between Shareholders’ funds to Total assets of the firm

- Proprietary ratio throws light on the general financial position of the enterprise. Proprietary Ratio shows the extent to which total assets have been financed by proprietor

b. Formula

- It is computed by dividing Shareholder Funds by Total Assets

- Proprietary Ratio = Shareholders or Proprietary Funds/Total Assets

- Shareholders Funds = Equity Share Capital + Preference Share Capital + Reserves and Surplus

- Total Assets = Non Current Assets + Current Assets

- Non-current assets (i.e. Tangible & intangible assets, non current investments + long term loans & advances)

- Current Assets (i.e. Current Investments + Inventories (excluding stores & spares and Loose tools) + Trade Receivables (Net) + Cash & Cash equivalents + Short Term Loans & Advances + Other Current Assets)

c. Important Considerations

- The Proprietary ratio is expressed in fraction

- The ideal range for Proprietary ratio is 0.5

- A ratio below 0.50 may be alarming for the creditors since they may have to lose heavily in the event of company’s liquidation on account of heavy losses

- A high ratio shows that there is safety for creditors of all types hence a higher ratio is better for the Organization

- This ratio is of particular importance to the creditors who can ascertain the proportion of shareholders’ funds in the total assets employed in the firm.

- Higher proportion of shareholders funds in financing the assets is a positive feature as it provides security to creditors

F. Interest Coverage Ratio

a. Meaning

- It is a ratio which deals with the servicing of interest on loan.

- It is a measure of security of interest payable on long-term debts

- It expresses the relationship between profits available for payment of interest and the amount of interest payable.

- It is also known as debt service ratio or fixed charges coverage ratio

- Interest Coverage Ratio is computed to measure the debt servicing capacity of a firm so far as fixed interest on long-term debt is concerned.

b. Formula

- It is computed by dividing Net Profit before by Interest on Long-term debts

- Interest Coverage Ratio = (Net Profit before Interest and Tax) / (Interest on Long-term debts)

- Net Profit before Interest and Tax = Profit after Tax + Tax + Interest on long-term debts

- Interest on long-term debts = interest on debentures, loans long-term debts or borrowings.

c. Important Considerations

- The Interest coverage ratio is expressed in times

- The ideal interest coverage ratio is 6 to 7 times

- This ratio shows how many times the interest charges are covered by the profits available to pay interest

- Higher the ratio, more secure the lender is in respect of payment of interest regularly.

- A higher ratio indicates that the Organization can meet its interest burden regularly.

Topic – 4 | ACTIVITY RATIOS

Study Material & Notes

Study Material & Notes for the Chapter 11

COMPANY – ACCOUNTING RATIOS

IV. ACTIVITY RATIOS

A. Meaning

- Activity ratios measure the efficiency or effectiveness with which a firm manages its resources.

- These ratios are also called turnover ratios because they indicate the speed at which assets are converted or turned over in Revenue from operations (sales).

- Higher turnover ratio means better utilisation of assets and signifies improved efficiency and profitability

- These ratios are expressed as ‘times’ and should always be more than one. These ratios are also known as Turnover or Efficiency ratios.

B. Type

1. Inventory Turnover Ratio

2. Trade Receivables Turnover Ratio

3. Trade Payables Turnover Ratio

4. Working Capital Turnover Ratio

C. Inventory Turnover Ratio

a. Meaning

- It determines the number of times inventory is converted into revenue from operations during the accounting period under consideration

- It expresses the relationship between the cost of revenue from operations and average inventory.

- It determines how many times inventory is purchased or replaced during a year.

b. Formula

- It is computed by dividing Cost of Revenue from Operations by Average Inventory

- Inventory Turnover Ratio = Cost of Revenue from Operation/Average Inventory

(i) Cost of Revenue From Operations = Net Sales +/– Gross Profit/Loss

(ii) Average Inventory = (Opening Inventory+Closing Inventory)/2

(iii) Cost of Revenue From Operations = Opening Inventory + Purchases (net) + Direct Expenses – Closing Inventory

c. Important Considerations

- The Inventory Turnover ratio is expressed in times

- This ratio measures how fast Inventory is moving and generating sales.

- The objective of calculating inventory turnover ratio is to ascertain whether investment in stock in trade is reasonable or not, ie, only the required amount is invested in stock-in-trade.

- It throws light on utilisation of inventory of goods. High turnover is good but it must be carefully interpreted as it may be due to buying in small lots or selling quickly at low margin to realise cash.

- Low turnover of inventory may be due to bad buying, obsolete inventory, etc., and is a danger signal.

- When figure of Cost of Revenue from Operations is not available, the Revenue from Operations may be put in place of Cost of Revenue from Operations. Similarly, if only closing inventory is given in the question, it may be treated as average inventory.

D. Trade Receivables Turnover Ratio

a. Meaning

- The liquidity position of the firm depends upon the speed with which trade receivables are realised.

- This ratio indicates the number of times the receivables are turned over and converted into cash in an accounting period

- It expresses the relationship between credit revenue from operations and trade receivable.

b. Formula

- It is computed by dividing Credit Revenue from Operations by Average Trade Receivables

- Trade Receivables Turnover Ratio = Credit Revenue from Opertions/Average Trade Receivables

(i) Credit Revenue From Operations = Total Revenue From Operations – Cash Revenue from Operation

(ii) Average Trade Receivables = (Opening Trade Receivables+Closing Trade Receivables)/2

(iii) Trade Receivables = Debtors + Bills Receivables

Note: Provision for doubtful debts is not deducted

c. Important Considerations

- The Trade Receivables Turnover ratio is expressed in times

- This ratio shows efficiency in the collection of amount due from trade receivables.

- Higher the ratio, better it is since it indicates that debts are being collected more quickly.

- In general, a high ratio indicates the shorter collection period which implies prompt payment by debtor and a low ratio indicates a longer collection period which implies delayed payment for debtors.

- If Credit Sales is not specified, then total sales will be deemed as Credit Sales.

- If there is no mention of the opening trade receivables in the problem, then only closing trade receivables (debtors & bill receivables) we be considered as average trade receivables.

E. Average Collection Period

a. Meaning

- This ratio indicates in how many days receivables are getting collected by the Organization

- This is also known as Debt Collection Period or Credit period

b. Formula

- It is computed by dividing Number of days/weeks/months in a year by Trade Receivables Turnover ratio

c. Important Considerations

- The actual collection period can be compared with the stated terms of the organization

- If it is longer than stated credit terms, then this indicates inefficiency in the process of collecting debtors.

F. Trade Payables Turnover Ratio

a. Meaning

- Trade payables turnover ratio indicates the pattern of payment of trade payable.

- This ratio helps in finding out the exact time a firm is likely to take in repaying to its trade payables.

- As trade payable arise on account of credit purchases, it expresses relationship between credit purchases and trade payable.

b. Formula

- It is computed by dividing Net Credit Purchases by Average Trade Payables

- Trade Payables Turnover Ratio = Net Credit Purchases/Average Trade Payables

(i) Net Credit Purchases = Total Purchases – Purchase Returns – Cash Purchases

(ii) Average Trade Payables = Opening Trade Paybles+Closing Trade Paybles/2

(iii) Trade Payables = Creditors + Bills Payables

c. Important Considerations

- The Trade Payables Turnover ratio is expressed in times.

- This ratio shows the number of times the creditors are turned over in relation to purchases

- A high turnover ratio shows the availability of less credit or early payments, hence a low turnover ratio is beneficial for the organization.

- Trade Payables turnover ratio helps in judging the efficiency in getting the benefit of credit purchases offered by suppliers of goods. A high ratio indicates the shorter payment period and a low ratio indicates a longer payment period

- If Credit Purchases is not specified, then total purchases will be deemed as Credit Purchases.

- If there is no mention of the opening trade payables in the problem, then only closing trade payables (creditors & bill payables) we be considered as average trade payables.

G. Average Payment Period

a. Meaning

- This ratio helps in finding out the exact time a firm is likely to take in repaying to its trade payables

b. Formula

- It is computed by dividing Number of days/weeks/months in a year by Trade Payables Turnover ratio

- Average Payment Period = Number of days or weeks or months in a year/Trade Payables Turnover Ratio

c. Important Considerations

- The average payment period can be compared with credit period offered by the suppliers.

- If it is longer than stated credit terms, then this indicates inefficiency in the process of settlement of creditors which may affect organization availability to get purchases on credit in future.

- A shorter payment period shows, organization is availing less credit period or making early payments.

H. Working Capital Turnover Ratio

a. Meaning

- Working capital turnover ratio measures the efficiency at which the working capital is utilised for business operations

- This ratio shows the relationship between working capital and revenue from operations.

- It shows the number of times the working capital has been rotated in generating sales in a year.

b. Formula

- It is computed by dividing Revenue From Operations by Working Capital

- Working Capital Turnover Ratio = Revenue from Operations/Working Capital

- Working Capital = Current Assets – Current Liabilities

c. Important Considerations

- The Working Capital Turnover ratio is expressed in times

- This ratio shows the number of times working capital has been employed in the process of carrying on business

- The objective of calculating Working Capital Turnover Ratio is to ascertain whether or not working capital has been utilized effectively in making revenue from operations

- A higher ratio indicates efficient utilisation of working capital in generating sales and a low ratio indicates the working capital is not properly utilised.

Topic – 5 | PROFITABILITY RATIO

Study Material & Notes

Study Material & Notes for the Chapter 11

COMPANY – ACCOUNTING RATIOS

V. PROFITABILITY RATIOS

A. Meaning

- These ratios are called profitability ratios because it measure the profitability of a business and helps in assessing the overall efficiency of the business.

- Profitability ratios examine the earning capacity and current operating performance of the organization which is the outcome of utilization of resources employed in the business.

- These ratios are helpful for the management to take remedial measures if there is a declining trend. Higher turnover ratio means better utilisation of assets and signifies improved efficiency and profitability

- These ratios are expressed as ‘percentage’

B. Type

1. Gross Profit Ratio

2. Operating Profit Ratio

3. Operating Ratio

4. Net Profit Ratio

5. Return on Investment

C. Gross Profit Ratio

a. Meaning

- Gross profit ratio as a percentage of revenue from operations is computed to have an idea about gross margin

- It expresses the relationship of gross profit to revenue from operations (net sales). Gross profit ratio shows the margin of profit.

b. Formula

- It is computed by dividing Gross Profit by Revenue From Operations

- Gross Profit Ratio = (Gross Profit/Revenue from Operations) X 100

- Gross Profit = Revenue from Operations – Cost of Revenue from Operations

- Cost of Revenue from Operations = Opening Inventory (excluding Stores and Spares and Loose Tools) + Net Purchases + Direct Expenses – Closing Inventory (excluding Stores and Spares and Loose Tools)

- Cost of Revenue from Operations = Cost of Materials Consumed + Purchases of Stock-in-Trade + Changes in Inventories of Finished Goods, WIP and Stock-in-Trade + Direct Expenses.

c. Important Considerations

- The Gross Profit ratio is expressed in percentage form

- It indicates gross margin on products sold.

- It also indicates the margin available to cover operating expenses, non-operating expenses, etc.

- Change in gross profit ratio may be due to change in selling price or cost of revenue from operations or a combination of both.

- A higher ratio is always considered a good sign as it means lower cost of goods sold as well as good returns for the owners.

- A low ratio may indicate unfavourable purchase and sales policy.

D. Operating Ratio

a. Meaning

- Operating Ratio is calculated to assess the operational efficiency of the business.

- It establishes relationship between cost of operations and revenue from operation (net sales).

b. Formula

- It is computed by dividing Operating Cost by Revenue from Operations

- Operating Ratio = (Operating Cost/Revenue from Operations) X 100

- Operating Cost = Cost of Revenue from Operations + Operating Expenses

- Cost of Revenue from Operations = Opening Inventory (excluding Stores and Spares and Loose Tools) + Net Purchases + Direct Expenses – Closing Inventory (excluding Stores and Spares and Loose Tools)

- Operating Expenses = Employees benefit expenses + expenses directly related to business (Office & administrative, selling & distribution, depreciation & amortisation)

c. Important Considerations

- The Operating ratio is expressed in percentage form

- This ratio is calculated to assess the operational efficiency of the business.

- A lower operating ratio is considered a healthy sign as it means higher margin, and thus, more profit

- It is very useful for inter-firm and intra-firm comparisons

E. Operating Profit Ratio

a. Meaning

- Operating Profit Ratio is calculated to assess the operating margin.

- It establishes relationship between operating profit and revenue from operation (net sales).

b. Formula

- It is computed by dividing Operating Profit by Revenue from Operations

- Operating Profit Ratio = (Operating Profit/Revenue from Operations) X 100

- Operating Profit = Gross Profit + Operating Income – Operating Expenses

- Operating Profit = Net Profit before tax + Non-operating Expenses – Non-operating Income

- Non-operating Expenses = Interest on Long-term Borrowings + Loss on Sale of Fixed Assets + Loss by theft/fire + Charity/Donation

- Non-operating Income = Interest received on investments + Profit on Sale of Fixed Assets + Interest/dividend received + Insurance Claim received

c. Important Considerations

- The Operating Profit ratio is expressed in percentage form

- This ratio is calculated to assess the operational efficiency of the business.

- Higher the ratio, the better is the profitability of the business

- It is very useful for inter-firm and intra-firm comparisons

d. Operating Ratio and Operating Profit Ratio

- Operating Ratio = Operating Cost / Revenue from Operations

- Operating Profit Ratio = Operating Profit / Revenue from Operations

- Operating Cost + Operating Profit = Revenue from Operations

- Operating Ratio + Operating Profit Ratio = (Operating Cost / Revenue from Operations) + (Operating Profit / Revenue from Operations)

- Operating Ratio + Operating Profit Ratio = Operating Cost + Operating Profit / Revenue from Operations

- Operating Ratio + Operating Profit Ratio = Revenue from Operations / Revenue from Operations

- Operating ratio and Operating profit ratio are complementary to each other and thus, if one each ratio Is deducted from 100, other ratio is obtained. In the form of formula :

- Operating Profit Ratio + Operating Ratio = 100

- Operating Profit Ratio = 100 – Operating Ratio

- Operating Ratio = 100 – Operating Profit Ratio

F. Net Profit Ratio

a. Meaning

- Net profit ratio is based on all inclusive concept of profit

- It relates revenue from operations to net profit after operational as well as non-operational expenses and incomes.

- Net profit ratio determines overall efficiency of the business.

- It expresses the relationship of Net profit to Revenue from operations (net sales).

b. Formula

- It is computed by dividing Profit after Tax by Revenue From Operations

- Net Profit Ratio = (Profit after Tax / Revenue from Operations) X 100

- Profit after Tax = Gross Profit + Operating Income + Non-operating Income – Operating Expenses – Non-operating expenses – Tax

c. Important Considerations

- The Net Profit ratio is expressed in percentage form

- It reflects the overall efficiency of the business, assumes great significance from the point of view of investors.

- A firm with a high net profit ratio is in an advantageous position to survive in case of rising cost of production and falling selling prices.

- Where the net profit ratio is low, the firm will find it difficult to withstand these types of adverse conditions.

G. Return on Investment

a. Meaning

- This ratio indicates how efficiently the management has utilised the funds employed by owners and lenders.

- It assesses the overall performance of the enterprise. It measures, how efficiently the resources entrusted to the business are used.

- It establishes the relationship between Net profit before interest, tax & dividend to Capital Employed (equity & debts).

b. Formula

- It is computed by dividing Profit before Interest Tax and Dividend by Capital Employed

- Return on Investments = (Profit before Interest, tax and Dividend / Capital Employed) X 100

- Capital Employed (Liabilities Approach): Share Capital + Reserves and Surplus + Long-term Borrowings + Long-term Provisions

- Capital Employed (Assets Approach): Non-Current Assets (Tangible Assets + Intangible Assets) + Non-current Investments + Long-term Loans and Advances) + Working Capital.

c. Important Considerations

- The Return on Investments ratio is expressed in percentage form

- The objective of calculating return on investment is to measure the earning power of the net assets of the business.

- This ratio is very important from Investors’ point of view in assessing whether their investment in the firm generates a reasonable return or not.

- The higher the Return on Investments, the more efficient the management is considered to be in using the funds employed.

- For inter-firm comparison, return on capital employed funds is considered a good measure of profitability

Multiple Choice Questions (MCQs)

Past Year Question Papers with solutions

Cash Flow Statement

Topic – 1 | Meaning, Objectives & Advantages

Study Material & Notes

Study Material & Notes for the Chapter 12

CASH FLOW STATEMENT

I. INTRODUCTION AND BASIC CONCEPTS

i. Meaning

- Cash Flow Statement is a statement that shows the cash flows, i.e., inflow and outflow of Cash and Cash Equivalents during a particular period

- Transactions that increase Cash and Cash Equivalents are inflows of Cash and Cash Equivalents and transactions that decrease it are outflows of Cash and Cash Equivalents.

ii. Cash

- Cash comprises of Cash on Hand, cash at bank and demand deposits (fixed deposits) with banks

iii. Cash Equivalents

- Cash Equivalents are short-term, highly liquid investments that are readily convertible into cash and which are subject to an insignificant risk of change in value.

- An investment normally qualifies as cash equivalent only when it has short maturity period of, say, three months or less from the date of acquisition, i.e., purchase.

- Examples: Current/Short-term Investments, Short-term deposits with Banks, Marketable Securities, Commercial Papers, Preference shares

iv. Statutory Requirements

- Cash Flow Statement is prepared according to the Accounting Standard-3 (Revised).

- The AS-3 (Revised) prescribes that Cash Flow Statement be prepared either by (i) Direct Method or (ii) Indirect Method

- Showing cash flow under three heads, namely:

- Cash Flow from Operating Activities;

- Cash Flow from Investing Activities; and

- Cash Flow from Financing Activities.

- Cash Flow Statement shows the net increase or net decrease of Cash and Cash equivalents under each activity, i.e., Operating, Investing, Financing separately and collectively.

v. Cash flow arising out of increase/decrease in Balance Sheet items

vi. Cash flows are inflow & Outflow of Cash & Cash Equivalents

vii. Objectives

a. Knowledge of movement of cash

- A cash flow statement discloses the speed at which the cash is being generated from current assets such as debtors, bills receivable, inventory etc., and the speed at which the current liabilities such as creditors, bills payable etc. are being paid.

- This information is very useful in testing the capacity of a business to meet its short-term liabilities maturing, say within one month or in the Immediate future.

- Thus, it enables the management to assess the true position of cash in future.

b. Helpful in decision-making

- Cash flow statement gives information about cash inflow from operations of business. Such information is used by management for certain decision-making, e.g., repayment of long-term loans, purchase of fixed assets etc.

c. Knowledge of cash flow for different activities separately

- An enterprise presents its cash flows from Operating, Investing and Financing activities. Classification by activity provides information that allows users to assess the impact of these activities on the financial position of the enterprise and the amount of its cash and Cash equivalents. This information may also be used to evaluate the relationship among these activities.

d. Knowledge of change in Cash

- A business may have made profit and yet is running short of cash. Similarly, a business may have suffered a loss and still has sufficient cash balance. A cash flow statement reveals reasons for such increase or decrease of cash balance.

viii. Advantages

- Cash Flow Statement is very useful in the evaluation of cash position of a firm. It helps in efficient and effective management of cash.

- Cash flow statement aims at highlighting the cash generated from operating activities.

- Cash flow statement helps in planning the schedule for repayment of loan schedule and replacement of fixed assets, etc.

- Cash is the centre of all financial decisions. It is used as the basis for the projection of future investing and financing plans of the enterprise

- Cash flow statement helps to ascertain the liquid position of the firm in a better manner. Banks and financial institutions mostly prefer cash flow statement to analyse liquidity of the borrowing firm.

- The Management reviews cash flow statements to understand the internally generated cash which is best utilised for payment of dividends.

ix. Preparation of Cash Flow Statement

- Compute Cash Flow from Operating Activities

- Compute Cash Flow from Investing Activities

- Compute Cash Flow from Financing Activities.

- Cash flows under each activity, i.e., Operating Activity, Investing Activity and Financing Activity as computed under Steps 1, 2 and 3 are added in Cash Flow Statement and the resultant amount is Net Increase or Decrease in Cash and Cash Equivalents

- Cash and Cash Equivalents balance in the beginning of the period is added to the cash flows as arrived under Step 4. The amount so determined should be equal to Cash and Cash Equivalents balance at the end of the year.

Topic – 2 | CASH FLOW FROM OPERATING ACTIVITIES & TREATMENT OF CERTAIN SPECIFIC ITEMS

Study Material & Notes

Study Material & Notes for the Chapter 12

CASH FLOW STATEMENT

II. CASH FLOW FROM OPERATING ACTIVITIES

i. Operating Activities

- Operating activities are the activities that constitute the primary or main activities of an enterprise

- These are the principal revenue generating activities (or the main activities) of the enterprise and these activities are not investing or financing activities.

- Cash flows from operating activities generally result from the transactions and other events that enter into the determination of net profit or loss

- The amount of cash from operations’ indicates the internal solvency level of the company, and is regarded as the key indicator of the extent to which the operations of the enterprise have generated sufficient cash flows to

- maintain the operating capability of the enterprise

- paying dividends

- making of new investments

repaying of loans without recourse to external source of financing.

ii. Operating Activities – Manufacturing/Trading/Service Co

iii. Operating Activities – Finance Companies

Cash Flow from Operation Activities – Four Major Steps

- Net Profit before Tax and Extraordinary Items

- Adjustments for Non Cash & Non Operating Activities

- Changes in Working Capital

- Payment of Income Tax

Presentation in the Cash Flow Statement

| SN | Particulars | Amount |

|---|---|---|

| (A) | Net Profit before Tax and Extraordinary Items (as per Working Note) | xxxxx |

| Adjustments for Non-cash and Non-operating expenses | ||

| (B) | Items to be Added | |

| Depreciation | xxxxx | |

| Interest on Bank Overdraft/Cash Credit | xxxxx | |

| Interest on Borrowings (Short-term and Long term) and Debentures | xxxxx | |

| Writing off Underwriting Commission/Share Issue Expenses | xxxxx | |

| Loss on Sale of Fixed Assets | xxxxx | |

| Increase in Provision for Doubtful Debts* | xxxxx | |

| (C) | Items to be Deducted | |

| Interest Income | xxxxx | |

| Dividend Income | xxxxx | |

| Rental Income | xxxxx | |

| (D) | Operating Profit before Working Capital Changes (A+B-C) | xxxxx |

| (E) | Add: Decrease in Current Assets and Increase in Current Liabilities | |

| Decrease in Inventories (Stock) | xxxxx | |

| Decrease in Trade Receivables (Debtors and Bills Receivable) | xxxxx | |

| Decrease in Accrued Incomes | xxxxx | |

| Decrease in Prepaid Expenses | xxxxx | |

| Increase in Trade Payables (Creditors and Bills Payable) | xxxxx | |

| Increase in Outstanding Expenses | xxxxx | |

| Increase in Advance Incomes | xxxxx | |

| (F) | Less: Increase in Current Assets and Decrease in Current Liabilities | |

| Increase in Inventories (Stock) | xxxxx | |

| Increase in Trade Receivables (Debtors and Bills Receivable) | xxxxx | |

| Increase in Accrued Incomes | xxxxx | |

| Increase in Prepaid Expenses | xxxxx | |

| Decrease in Trade Payables (Creditors and Bills Payable) | xxxxx | |

| Decrease in Outstanding Expenses | xxxxx | |

| Decrease in Advance Incomes | xxxxx | |

| (G) | Cash Generated from Operations (D+E-F) | xxxxx |

| (H) | Less: Income Tax Paid (Net of Tax Refund) | xxxxx |

| (I) | Cash Flow before Extraordinary Items | xxxxx |

| Extraordinary Items (+/-) | xxxxx | |

| (J) | Cash Flow from (or Used in) Operating Activities | xxxxx |

Working Note

| SN | Particulars | Amount |

|---|---|---|

| Net Profit as per Profit & Loss Account or Closing – Opening P&L | xxxxx | |

| Add: | ||

| Proposed Dividend (Previous year) paid during the year | xxxxx | |

| Interim/Final Dividend paid on Equity/Preference Shares | xxxxx | |

| Provision for Taxation (Current Year’s only) – Net of refund | xxxxx | |

| Transfer from P&L A/c to Reserves | xxxxx | |

| Loss/Expenses due to extraordinary items debited to P&L | xxxxx | |

| Less: | ||

| Refund of Tax credited to P&L A/c | xxxxx | |