Study Material & Notes for the Chapter 4

Partnership - Admission of a Partner

V. ADJUSTMENT OF CAPITAL

- Sometime, at the time of admission, the partners’ agree that their capitals be adjusted in proportion to their profit sharing ratio

- Two methods of Adjustment of Capital

a) Capital of new partner’s is computed in proportion to the total capital of the new firm

b) Adjustment of existing partners capital on the basis of New Partner’s Capital

- For this purpose, the capital accounts of the existing partners are prepared, making all adjustments, on account of goodwill, free reserves , accumulated losses and revaluation of assets/reassessment of liabilities.

- The actual capital so adjusted will be compared with the amount of capital that should be kept in the business after the admission of the new partner.

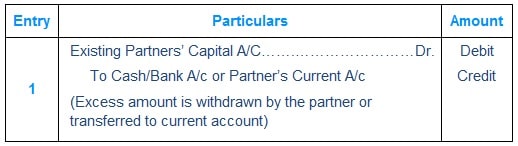

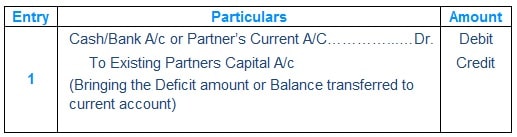

- The excess if any, of adjusted actual capital over the proportionate capital will either be withdrawn or transferred to current account and vice versa.

- When Revaluation Account is prepared, assets and Liabilities appear in the Balance Sheet of the reconstituted firm at their revised (changed) values

I. Capital of new partner’s is computed in proportion to the total capital of the new firm

-

- The capital accounts of the existing partners are prepared, making all adjustments, on account of goodwill, free reserves , accumulated losses and revaluation of assets/reassessment of liabilities.

- Compute Capital of new partner with reference to Combined Capital of existing partners

II. Capital of new partner’s is computed in proportion to the total capital of the new firm

Step-1 Firm’s Total Capital = New Partner’s Capital X Reciprocal of new partner’s share

Step-2 Specific Partner’s New Capital = Firm’s Total Capital X Specific Partner’s share

Step-3 Specific Partner’s Existing Capital = Old Capital (+)(-) Adjustments of Goodwill, Reserves & Accumulated Losses

Step-4 Capital to be introduced/withdrawn = Specific Partner’s New Capital – Specific Partner’s Existing Capital